Econometrics

Course introduction

_____________________________________________________________________________________

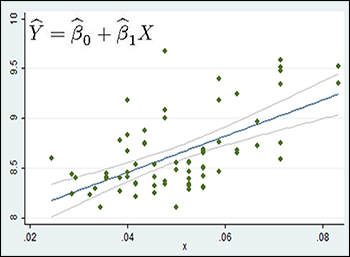

Image courtesy of the authors of the course |

Econometrics

CÉSAR ALONSO-BORREGO

JESÚS CARRO Department of Economics, Universidad Carlos III de Madrid Area: Foundations of Economic Analysis. Applied Economics Bachelor's Degree in Economics, Bachelor's Degree in Business Administration, |

Estimated learning time: 120 hours, weighted at the 50% between theory and practice.

PRERREQUISITES AND RECOMMENDED PREVIOUS KNOWLEDGE

Students must be familiar with probability theory and statistical inference.GENERAL DESCRIPTION OF THE COURSE

This course introduces the student into the use of quantitative techniques aimed at the empirical analysis of causal relationships between economic variables. The main tool is the linear regression model, which is discussed both at the theoretical

and at the applied level. The course emphasizes the empirical analysis, for which it uses real economic data and open econometric software.

OBJECTIVES: KNOWLEDGE AND SKILLS

The major aim is to enable the student in the use of the linear regression model as a tool for quantifying causal relationships between economic variables exploiting empirical evidence. The teaching approach emphasizes the intuitive discussion of concepts and the use of actual databases, to provide the student a practical grasp of the econometric techniques and the software. The major concern will be the link between the different hypotheses about the data and the economic variables with the assumptions required to ensure the appropriateness of the models and its validation through empirical analysis.

After finishing the course, the student must understand:

- The difference between correlation and causal relation

- The interpretation of the linear regression model under the classical assumptions

- The ordinary least squares estimation

- The use of qualitative information

- The consequences of omitting relevant variables

- The concepts of endogeneity and simultaneity and its implications

- The instrumental variable estimation

- How to test whether a explanatory variable is exogenous or endogenous

- The consequences of heteroskedasticity and how to make inference under its presence

- The time dependence in time-series data, the phenomenon of autocorrelation and its consequences on inference

TEACHING MATERIAL

In addition to the syllabus and the bibliographic references, each topic includes its corresponding document with explanations about the relevant issues, including both examples and the main algebraic developments. The explanations in such documents are provided in a schematic way, which facilitate the student a track to follow the course, and are intended to be self-contained. Their main purpose is to provide a basic learning guide, so as the student could complement with any of the course references when the student finds necessary.

PRACTICAL ASSIGMENTS AND ASSESSMENT ACTIVITIES

Half of the required work for the course is concerned with the exercise worksheets that are available for each corresponding topic. Such worksheets include both analytical, theoretical and practical exercises, which require using the real data files that are also provided.

Finally, four evaluation documents, with their corresponding solutions, are available, to allow the self-assessment of student learning. Since all the evaluation documents span the same contents, it is recommended to use some of them as further worksheets to reinforce learning, and to use others as a final exam. Each evaluation document contains the instructions to be used as self-assessment tests.